Insurance Claims Services

We offers insurance claim services which will work with the insurance company

on behalf of the customer to handle the claim process.

Insurance Claims Services

- Initial estimate:

The body shop will provide an initial estimate of the repair costs to the insurance company, including parts, labor, and any necessary additional repairs. - Approval of estimate:

The insurance company will review the estimate and may send an adjuster to inspect the vehicle and confirm the estimate. - Negotiation and agreement:

The body shop and the insurance company may negotiate the repair estimate, and once an agreement is reached, the insurance company will issue payment for the repairs. - Repair work:

The body shop will complete the necessary repairs, following OEM procedures and guidelines, and will provide the insurance company with a final invoice. - Final settlement:

The insurance company will review the final invoice and issue a final settlement payment to the body shop, and any remaining balance due will be paid by the customer.

Insurance claim services help streamline the process of repairing vehicles after an accident and provide customers with peace of mind knowing that their repair costs are covered by their insurance policy. By working with insurance companies, body shops can help ensure that repairs are completed according to OEM procedures and guidelines, and that the safety and structural integrity of the vehicle are not compromised.

*NOTE: “STEERING”

In the insurance world of auto body repair, steering refers to the practice of an insurance company directing a policyholder to a specific body shop or repair facility. This can happen when an insurance adjuster tries to influence a policyholder to take their vehicle to a particular body shop or repair facility that is part of the insurance company’s preferred network.

Steering can be illegal if the insurance company is using coercive or deceptive tactics to direct the policyholder to a specific repair facility. It can also be a violation of consumer rights if it limits the policyholder’s ability to choose the body shop or repair facility of their choice.

In some cases, insurance companies may try to steer policyholders to a specific body shop or repair facility in an effort to control the cost of repairs. Preferred network repair facilities may offer discounts or special rates to insurance companies in exchange for a higher volume of referrals, which can help the insurance company reduce their claims costs.

It’s important for policyholders to understand that they have the right to choose the body shop or repair facility of their choice, regardless of the insurance company’s preferred network. By choosing an auto body shop that follows OEM procedures and guidelines, policyholders can ensure that their vehicle is repaired properly and that their safety is not compromised.

WHAT OUR CUSTOMERS ARE SAYING:

Mon - Thur: 7:00AM - 5:00PM | Fri: 9:00AM - 12:00PM | Sat - Sun: Closed

Mon - Thur: 7:00AM - 5:00PM | Fri: 9:00AM - 12:00PM | Sat - Sun: Closed

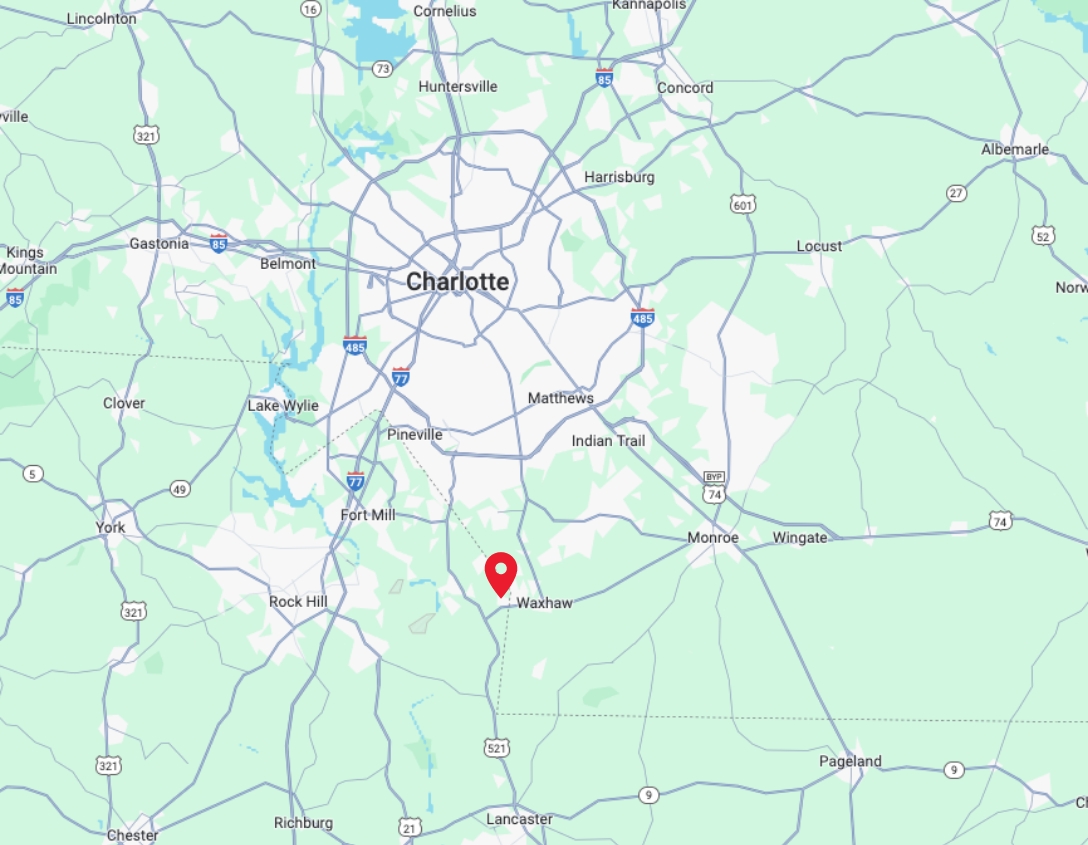

Located in WAXHAW & INDIAN LAND

Located in WAXHAW & INDIAN LAND